The real estate market is constantly evolving, and as a buyer, it's essential to stay informed about the latest trends and updates. One crucial aspect that greatly influences the affordability of purchasing a property is the mortgage rates. In this blog post, I will provide an outlook on the mortgage rate market and how it may impact buyers.

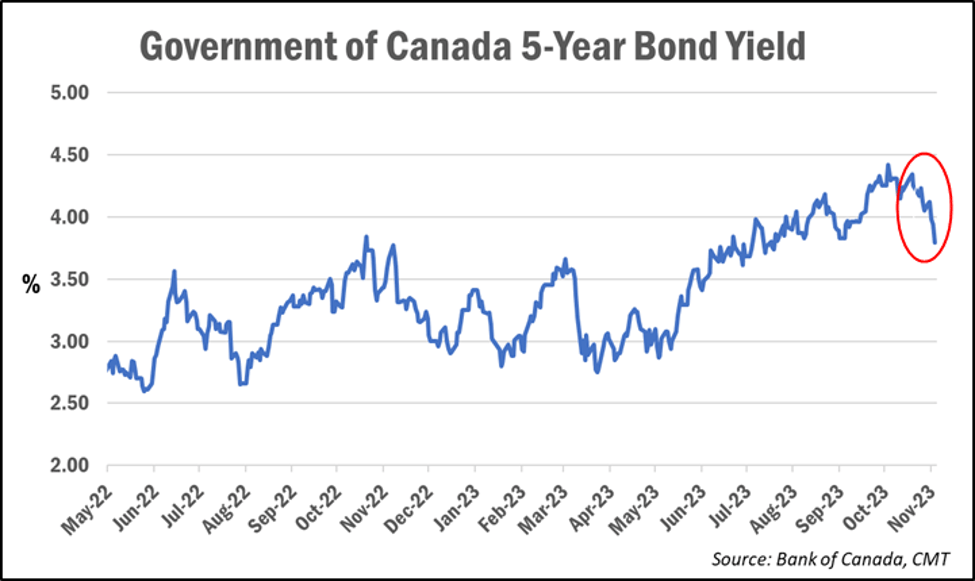

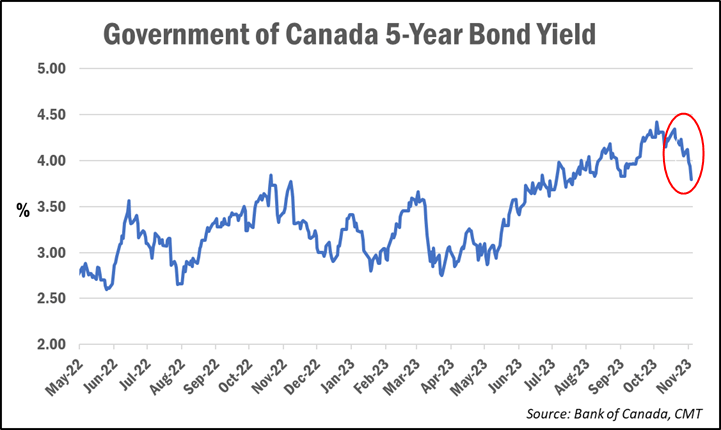

Recently, there has been a significant decrease in bond yields, which is often an indicator of future mortgage rate adjustments. As bond yields decrease, it foreshadows a potential rate decrease in the near future. This is great news for buyers as lower mortgage rates mean more affordability and flexibility in financing their dream home.

However, it's important to note that while lower rates are generally favourable for buyers, they can slightly increase the purchase price of properties. This occurs because the lower the interest rate, the buyers' borrowing power increases. Sellers capitalize on this buying power, leading to a slight increase in purchase prices.

Despite this potential increase in purchase price, the overall benefit of lower mortgage rates outweighs the slight price hike. For instance, if you were considering buying a $300,000 home with a 20% down payment and a mortgage rate of 4%, your monthly payment (excluding taxes and insurance) would be approximately $1,145. However, if the mortgage rate decreases to 3.5%, your monthly payment would decrease to approximately $1,070.

This decrease of $75 per month might not seem significant at first glance, but throughout a 30-year mortgage, it accumulates to a savings of $27,000. This considerable amount can be used for other investments or to pay off the mortgage sooner. Thus, lower mortgage rates provide buyers with more financial freedom and long-term savings opportunities.

As the market update suggests a potential decrease in mortgage rates, it's an ideal time for buyers to take advantage of this situation. Securing a low mortgage rate can significantly impact your purchasing power and overall financial stability. To capitalize on this opportunity, it's crucial to consult with a trusted mortgage lender who can guide you through the process and help you make informed decisions.

In conclusion, the outlook for mortgage rates is optimistic for buyers. The decrease in bond yields foreshadows a potential rate decrease, leading to more affordability and flexibility in financing properties. While this might slightly increase purchase prices, the long-term benefits of lower rates, such as savings and financial freedom, make it an ideal time to enter the real estate market. Stay informed, consult with professionals, and make the most of this favourable mortgage rate outlook.

.png)