In recent times, the terms 'deflation' and 'disinflation' have frequently surfaced in economic discussions, especially in light of Canada's latest Consumer Price Index (CPI) report and its implications for the real estate sector. While these terms may sound similar, they describe distinct economic conditions with different impacts on the country's financial health. Understanding these concepts is crucial for anyone looking to navigate the complexities of the economy, whether you're an investor, homeowner, or simply keeping a keen eye on market trends.

CPI Decrease:

The latest Consumer Price Index (CPI) figures show a modest reduction from 2.9% to 2.8%. This decline is largely due to lower prices for cell phones, internet services, and food. However, a slight increase in gas prices has exerted some upward pressure on the CPI. Meanwhile, consumers continue to grapple with high mortgage interest and rent payments, contributing significantly to inflationary pressures. Despite recent declines in the CPI, economists remain pessimistic about the prospects of an interest rate cut in the near term.

Deflation vs. Disinflation: Unraveling the Difference

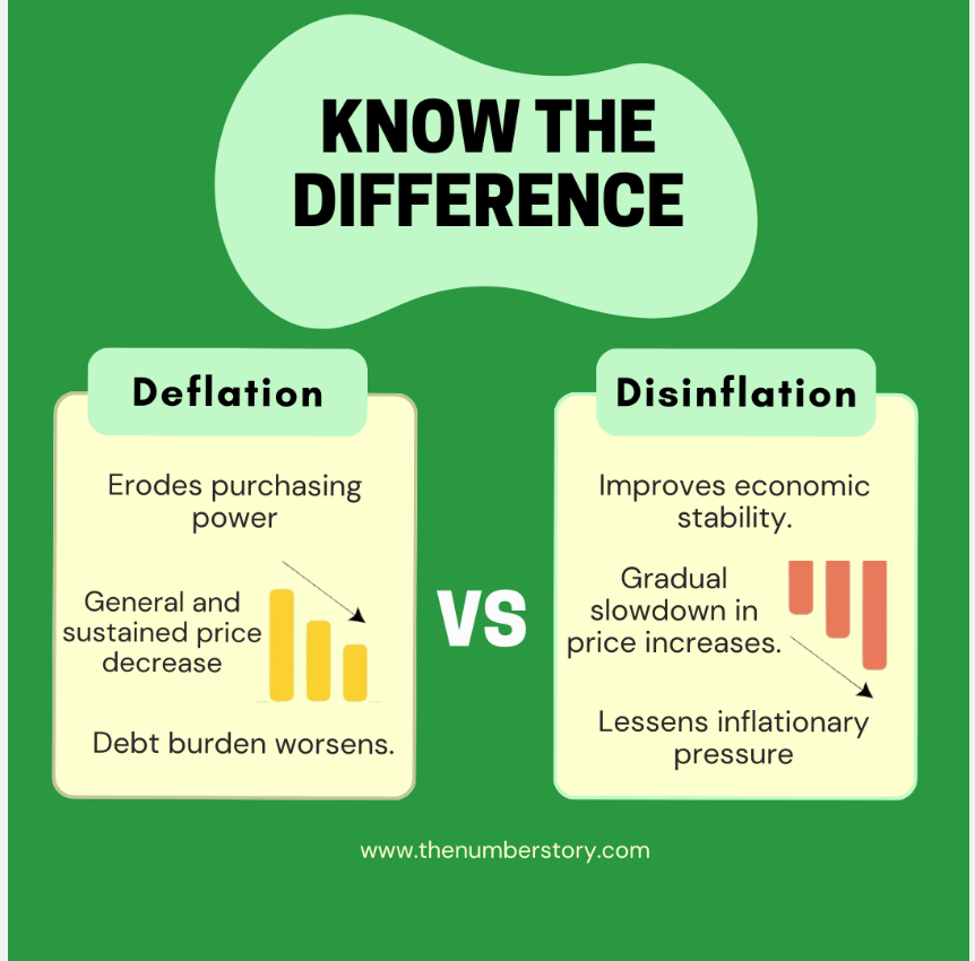

At its core, deflation refers to a general decline in the price level of goods and services within an economy over a period. This phenomenon is characterized by a negative inflation rate, indicating that the purchasing power of money is increasing. While this might sound beneficial at first glance, deflation can lead to decreased consumer spending. As people anticipate lower prices in the future, they might postpone purchases, which can slow economic growth and lead to higher unemployment rates.

Disinflation, on the other hand, is a slowdown in the rate of inflation. It signifies a reduction in the pace at which prices are rising, not a decrease in prices themselves. Disinflation is often seen as a positive sign of a stabilizing economy because it indicates that inflationary pressures are easing while avoiding the potential pitfalls of deflation.

Canada's CPI Release: A Closer Look

Canada's recent CPI data has become a focal point for both economists and the public, given its direct implications for household budgets and the broader economy. The CPI measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Understanding whether the country is experiencing deflation, disinflation, or inflation is vital for policy-making and economic forecasting.

Impact on Real Estate

The real estate market is particularly sensitive to changes in inflation and deflation. In periods of deflation, the nominal value of properties may decrease, leading to reduced investor confidence and a potential slowdown in the housing market. Conversely, disinflation can create a more stable economic environment, supporting steady growth in the real estate sector. For Canada, which has seen significant fluctuations in its real estate prices, distinguishing between deflation and disinflation is key to predicting future market trends.

Recent CPI releases suggest a period of disinflation, where the growth rate of real estate prices is slowing but not declining. This could signal a more balanced market ahead, offering opportunities for buyers waiting for the right moment to enter the market and for sellers aiming to capitalize on stabilizing prices.

Conclusion

Understanding the difference between deflation and disinflation is more than an academic exercise; it's crucial for making informed decisions in today's economic climate. As Canada navigates through these varying economic conditions, stakeholders in the real estate market and beyond will need to pay close attention to CPI releases and other indicators. By doing so, they can better anticipate market movements and position themselves advantageously in an ever-evolving financial landscape.

The distinction between deflation and disinflation offers valuable insights into the health of the economy and provides a lens through which to view Canada's recent economic data and its impact on sectors like real estate. As we continue to monitor these trends, it's clear that understanding these concepts is essential for anyone looking to thrive in Canada's complex economic environment.

.png)